mississippi state income tax rate

Each marginal rate only applies to earnings within the applicable marginal tax bracket. Counties and cities can charge an additional local sales tax of up to 55 for a maximum possible combined sales tax of 12.

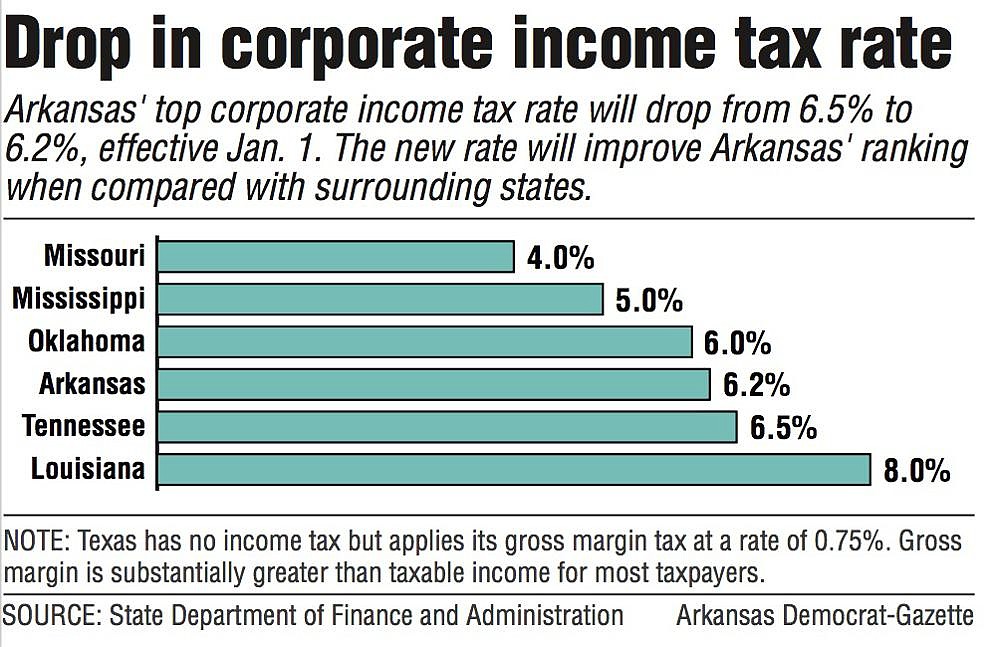

Top Corporate Income Tax Rate Declines

Improving Lives Through Smart Tax Policy.

. This table includes the per capita tax collected at the state level. North Carolinas 25 percent corporate tax rate is the lowest in the country followed by Missouri 4 percent and North Dakota 431 percent. 2022 Maryland tax brackets and rates for all four MD filing statuses are shown in the table below.

Minnesota collects a state income tax at a maximum marginal tax rate of spread across tax brackets. State Income Taxes 2022. Nebraskas maximum marginal income tax rate is the 1st highest in the United States ranking directly.

For a visual comparison of state income taxes across the United States see our state. Like the Federal Income Tax Nebraskas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Filing a State Tax Return or Tax Extension.

Is not a state but it has its own income tax rate. State tax levels indicate both the tax burden and the services a state can afford to provide residents. Check on the tax refund status for a given state.

Minnesotas maximum marginal income tax rate is the 1st highest in the United States ranking directly. Hawaii collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate.

The Federal Income Tax in contrast to the Illinois income tax has multiple tax brackets with varied bracket width for single or joint filers. New York has eight marginal tax brackets ranging from 4 the lowest New York tax bracket to 882 the highest New York tax bracket. By contrast the median state-local tax burden is 102 percent and the national average is 116 percent.

The Arkansas state sales tax rate is 65 and the average AR sales tax after local surtaxes is 926. The table below shows the number of tax brackets in states plus DC with progressive tax structures. We can also see the progressive nature of Georgia state income tax rates from the lowest GA tax rate bracket of 1 to the.

And of course Washington DC. Maryland state income tax rate table for the 2022 - 2023 filing season has eight income tax brackets with MD tax rates of 2 3 4 475 5 525 55 and 575. Florida Lawmakers Should Provide Certainty Around the States Corporate Income Tax.

State individual income tax rates and brackets State. Detailed Washington state income tax rates and brackets are available on this page. TAX DAY IS APRIL 17th - There are 168 days left until taxes are due.

One at a 7 rate and one at a 25 rate. Prepare ONLY one or more state income tax returns online and mail them to the states. Start filing your tax return now.

In many states. Like the Federal Income Tax Minnesotas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Are met a reduced two-tier individual income tax rate structure of 253 and 275 or a 25 tax rate beginning in 2023.

Florida 4458 percent Colorado 455 percent Arizona 49 percent Utah 495 percent and Kentucky Mississippi and South Carolina 5 percent. This data can be downloaded as an Excel file courtesy of The Tax Foundation. The average property tax rate in Rankin County is just 067.

Mississippi allows you to use the same itemized deductions for state income tax purposes as you use for federal income tax purposes with one exception. Prepare and eFile your state income tax returns. Illinois has a flat income tax rate which applies to both single and joint filers.

For example Hawaii has a top tax rate of 11 and 12 income brackets while Iowa has a top tax rate of 853 and nine income brackets. On November 18 2021 the states flat. New York 159 percent of state income Connecticut 154 percent and Hawaii 141 percent.

Prescription Drugs are exempt from the Arkansas sales tax. If you are looking for low property taxes in Mississippi Rankin County might be a good choice. Below is a state income tax navigation chart that allows you to easily pick the right route to either.

Mississippi has a graduated tax rate. The state has been slowly eliminating its lowest tax bracket by exempting 1000 increments every year since 2018. Mississippi Income Taxes are not deductible on your itemized deduction schedule requiring that an adjustment be made for that exception.

These rates are. Under SB 1828 and effective January 1 2022 the law createsa two-tier individual income tax rate structure of 255 and 298 depending on filing status and taxable income and if general fund revenue thresholds. Seven other states impose top rates at or below 5 percent.

Note that the dollar amounts in the income brackets apply to single filers. New Yorks income tax rates were last changed one year prior to 2020 for tax year 2019 and the tax brackets were previously changed in 2016. States use a different combination of sales income excise taxes and user feesSome are levied directly from residents and others are levied indirectly.

The state also consolidated five individual income tax brackets into four and reduced the second-highest rate from 31 to 3 percent. Mississippi modernisation of existing corporate and individual taxes from 1924. This page lists state individual income tax rates for all fifty states including brackets for those filing both as an individual and jointly with a spouse.

E Mississippi finished phasing out its 3 percent bracket at the start of 2022. Delawares corporate income tax rate is 87. Arizona transitioned from a four-bracket individual income tax with a top rate of 45 percent to a two-bracket system with a top rate of 298 percent a waypoint on the states transition to a 25 percent single-rate tax.

The rate in Shelby County is 142 almost double the rate in Mississippis DeSoto County. Hawaiis maximum marginal income tax rate is the 1st highest in the United States ranking directly. Like the Federal Income Tax Hawaiis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

The most recent county average millage rate in Rankin County is 11159 mills. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. Illinois income tax rates were last changed four years prior to 2020 for tax year 2016 and the tax brackets have not been changed since at least 2001.

Notable Ranking Changes in this Years Index Arizona. Arkansas has 644 special sales tax jurisdictions with local sales taxes in addition to the. Oklahoma reduced its corporate income tax rate from 6 to 4 percent tying Missouri for the second-lowest rate in the nation.

Nebraska collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Looking at the tax rate and tax brackets shown in the tables above for Georgia we can see that Georgia collects individual income taxes differently for Single versus Married filing statuses for example. In addition legislation was adopted in Utah in February that reduces both the individual and corporate income tax rates from 495 to 485 percent effective for tax year 2022.

As of January 1 2022 Mississippi has completed the phaseout of its 3 percent individual income tax brackets. Detailed Mississippi state income tax rates and brackets are available on this page. Prior to 2022 the Pelican States top rate ranked 25th.

The residents of three states stand above the rest experiencing the highest state-local tax burdens in the country. Georgia Tax Brackets 2022 - 2023. State income tax is allowed as an itemized deduction in computing federal income tax.

Top States For Business 2022 Mississippi

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

State Corporate Income Tax Rates And Brackets For 2019

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Mississippi Income Tax Calculator Smartasset

State Income Taxes Highest Lowest Where They Aren T Collected

Mississippi Income Tax Brackets 2020

If Doctors Chose Their Job Locations Based On State Income Taxes White Coat Investor

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

Minnesota Should Reduce Its Individual Income Tax Rates American Experiment

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Four More States Move To A Flat Tax Illinoisans Were Right To Reject Pritzker S Progressive Income Tax Wirepoints Wirepoints

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

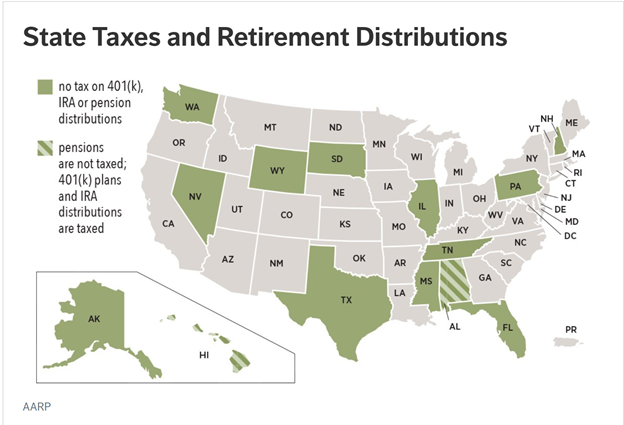

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Mississippi Income Tax Reform Details Evaluation Tax Foundation

Payroll Software Solution For Mississippi Small Business

State Individual Income Tax Rates And Brackets Tax Foundation

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)