do pastors file taxes

For tax purposes a minister is a person who is a duly ordained commissioned or licensed minister of a church This includes Rabbis and. What form does a pastors income get filed under.

There are ministers who have never filed a federal income return and it is easy to understand why.

. Ministers are not exempt from paying federal income taxes. You must file it by the due date of your income tax return including extensions for the second tax year in which you have net earnings from self-employment of at least 400. Up to 25 cash back By Stephen Fishman JD.

But clergy are both exempt from federal income tax withholding and considered self-employed for Social Security tax purposes. Pastors fall under the clergy rules. This income is taxable to you.

This means a church normally wont withhold. Instead religious leaders pay their contributions through the Self-Employment Contribution Acts tax. No Tax Knowledge Needed.

A pastor has a unique dual tax status. For example if a minister estimates that his. While they can be considered an employee of a church for federal income tax purposes a pastor is considered self-employed by the IRS.

Income as a minister is taxable whether youre connected to a church or are an independent evangelist. After filing his tax return Pastor 2 ended up with 64167. Pastors fall under the clergy rules.

You must file Form 4361 by the due date of your tax return for the second tax year in which you earned at least 400 of self-employment earnings as a minister. Pastors are exempt from income tax withholding and are not obligated to have federal taxes withheld from their paychecks. The big difference is that with self-employment tax pastors have to pay.

Any withholdings are subtracted and the remaining. Let those numbers sink into your mind. They are considered a common law employee of the church so although they should receive a W2.

A tax professional with church-related experience can walk you through the dos and donts to ensure. When you file your minister tax return with. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

After paying his tax bill Pastor 1 ended up with 49125 in his pocket. Taxes for pastors basically boils down to being considered self-employed by the IRS and self-employed tax returns are our specialty. E-File Your Tax Return Online.

How do pastors file taxes. Many pastors believe their housing allowance is completely tax-free but thats not the case. When a pastor files Form 1040 both the federal income taxes and SECA taxes are lumped together into a final tax bill.

Others are not familiar. Since 1943 Murdock v. As a person of the cloth whether you are a Rabbi a Priest or a Minister you have a special tax situation.

Capture Your W-2 In A Snap And File Your Tax Returns With Ease. The minister who is considered a church employee must complete a form W-4 and request that a specific amount be withheld from each paycheck. Some ministers believe they are exempt from taxation.

Members of the clergy and other religious workers should file Form 1040 Schedule SE and review Publication 517 to pay social security and Medicare taxes. 105 the United States Supreme Court has ruled that the First. They are considered a common law employee of the church so although they do receive.

If you are a member of the clergy you should receive a Form W-2 Wage and Tax Statement from your employer reporting your salary and any housing allowance. Generally there are no income. However whether youre considered an employee or self-employed.

Pastors fall under the clergy rules. Pastors may voluntarily choose to ask their.

Nts Faq Reporting Pastor S Income On Forms W 2 And 941

Churches Should Pay Taxes Atheist Pastor Religion

File Taxes Online E File Federal And State Returns 1040 Com

How Pastors Pay Federal Taxes The Pastor S Wallet

Clergy Tax Guide Howstuffworks

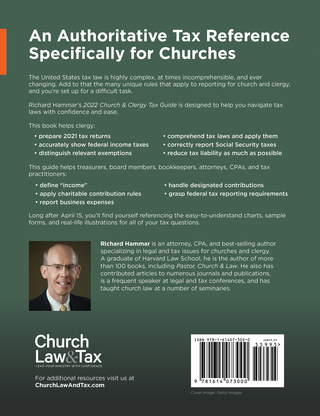

2022 Church Clergy Tax Guide Clergy Financial Resources

Tax Preparation For Pastors And Clergy Tax Preparation Our Services

Pin On Girl Boss Tips Tricks For Saving On The Job

Nts Faq Reporting Pastor S Income On Forms W 2 And 941

The Pastor S Tax Man Clergy And Minister Taxes Simplified

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

It S That Time Of Year Again 1040taxes Is Hands Down The Best Way To File Your Taxes Especially If Giving Back Is A P Diy Taxes Clean Water Developed Nation

If They Re So Interested In Getting Into Politics And Telling Us How To Live Our Lives Let Them Pay Taxes Like The Rest Of Us Fix It Jesus Pastor Humor

What Taxes Can Churches Withhold For Pastors The Pastor S Wallet

Dual Tax Status What Does It Mean For Your Pastor American Church Group Tennessee

File Taxes Online E File Federal And State Returns 1040 Com Filing Taxes Online Taxes File Taxes Online

Church Tax Conference For Small Churches Alabama Baptist State Board Of Missions